Форекс Брокеры

Are Savings and Investment taken Ex Ante or Ex Post while calculating

It involves forecasting returns of a security or an asset based on actual data. The government will pass further policy changes to keep inflation under control. Since the event will take place in the future, it is unknown how the economy will perform.

As such, any risks that an investor or other individual may experience in the future can be determined using statistical measurements based on the investment’s long-term returns. On the other hand, ex-post means “after the event,” while ex-ante means “before the event.” Ex-post is backward-looking, and it looks at results after they have already occurred. For investment companies, analysts can use historical returns to forecast the probability of making a profit or loss on an investment.

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Ex-ante costs are any investment expenses that are both implicit (those that take place without the exchange of cash) and explicit (those that affect an investment’s overall profitability). These costs are normally based on the last 36 months of the investment’s costs compared to its average total assets under management (AUM).

What is the Difference Between Ex Ante Investment and Ex Post Investment? – Economics

As a final example, priority in bankruptcy gives the right to the first creditor of the same secured debt, but not to the first creditor of unsecured debt. This article presents an efficiency-based framework for answering these questions. Ex-post risk is often used in value at risk (VaR) analysis, which is a tool used to give investors the best estimate of the potential loss they could expect to incur on any given trading day. Ex-post analysis is the traditional approach of performance analysis for long-only funds.

Unlike unplanned investment, which is usually connected and required, plan spending is part of Budget forecasts that are decided following consultations with ministries and stakeholders. Taxes, customs charges, the sale or leasing of natural resources, and different fees such as national park admission fees or licensing fees can all be used to fund government spending. When governments borrow money, they are required to pay interest on the borrowed funds, which can result in government debt.

What Is Ex-Post Risk?

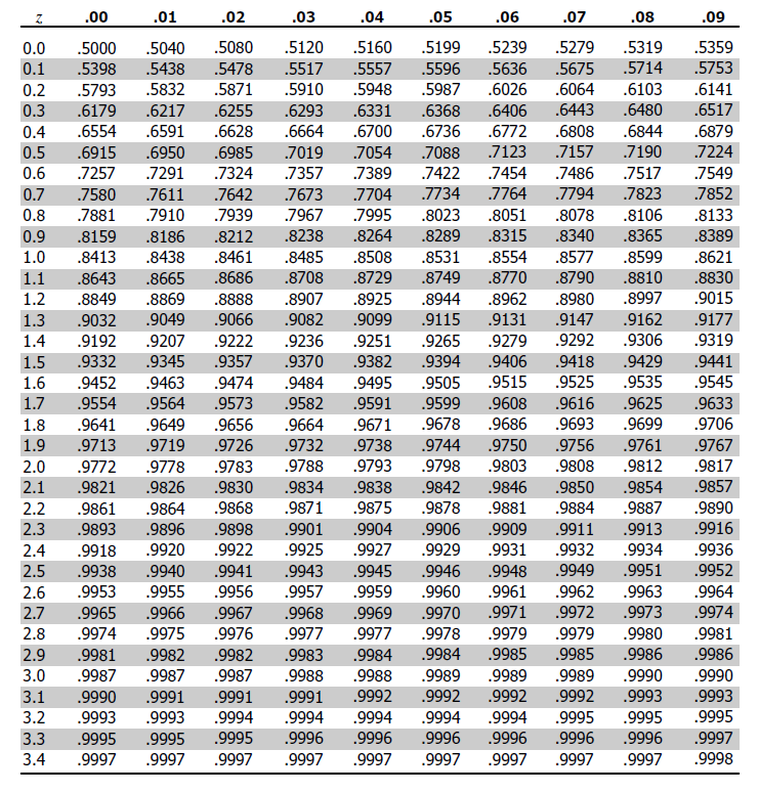

In the financial world, ex-ante is the return that investors expect to earn from an investment portfolio. The term can also apply when calculating earnings estimates of a whole business unit or an individual unit. The actual outcome is not known for certain, but making the prediction of the expected returns serves as the basis for comparing the predicted performance and the actual performance. The value obtained can then be used to analyze investment price fluctuations or earnings, and predict the expected returns of a security or investment. The ex-post value (actual returns based on historical returns) can then be compared to the predicted returns to determine the accuracy of the risk assessment methods used. For example, when measuring the returns of a security from October 1 to December 31, calculate the difference between the starting value on October 1 and the ending value on December 31.

- If you believe you should have access to that content, please contact your librarian.

- Planned investment is a component of government spending that aids in the expansion of the economy’s productive capacity, and it is similar in the case of a business firms’ investment.

- As a result, market participants are unaware of the event and its relevant information; the actual outcome is still unknown.

- That’s why price targets that account for many fundamental variables sometimes miss the mark due to exogenous market shocks that affect nearly all stocks.

- The term ex-ante interest rate refers to the real interest rate calculated before the actual rate is revealed.

Ex-ante risk refers to any of the returns that an investment earns before that risk actually takes place. The formula for calculating ex-post is (ending value – beginning value) / beginning value. Ex-post is a forecast prepared at a certain time that uses data available after that time. The forecasts are created when future observations are identified during the forecasting period. For example, the Federal Reserve makes ex-ante predictions on expected inflation to decide whether to raise or lower interest rates.

Uncertainty of Ex-Ante Analysis

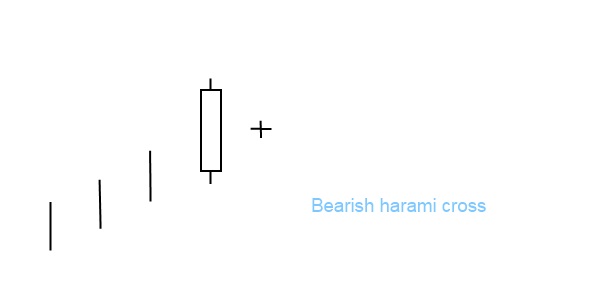

The predicted outcome serves as a basis for comparing the prediction to the actual results (ex-post). For example, when preparing a merger of two competitors, analysts can predict the expected synergies that will emerge from such a transaction before it actually happens. The synergies may be in terms of changes in the share price, as well as the estimated earnings of the combined entity. The prediction difference between ex ante and ex post investment can happen before the merger happens or immediately after the merger happens, but there is uncertainty about the possible effects of the transaction. The ex-post value can be compared with predicted returns to check the risk assessment methods’ accuracy. The derived value can then be used to assess investment price variations, earnings, or projected returns of a security or investment.

ESMA highlights areas for improvement in firms’ disclosure of cost … – ESMA

ESMA highlights areas for improvement in firms’ disclosure of cost ….

Posted: Thu, 06 Jul 2023 07:00:00 GMT [source]

This is common for earnings reports and other major events like mergers. Keep in mind, though, that this isn’t an exact science since it is based on forecasts rather than results. Ex-post is calculated using the beginning and ending asset values for a specific period, any growth or decline in the asset value, plus any earned income produced by the asset during the period. Analysts use ex-post data on investment price fluctuations, earnings, and other metrics to predict expected returns. It is measured against the expected return to confirm the accuracy of risk assessment methods. In simple terms, it is the prediction of an event before it actually happens, and the actual outcome is uncertain.

Are Savings and Investment taken Ex Ante or Ex Post while calculating equilibrium Point

They can determine this using ex-ante analysis conducted by financial professionals. These experts break down and compare revenue streams and determine how compatible they are with one another. They can also use forecasting to determine if the merger will result in savings if a new company is formed by conducting a cost-benefit analysis. Ex-post is another word for actual returns and is Latin for after the fact.

Therefore, ex-ante analysis cannot be relied upon entirely when making financial decisions. The beginning value is the market price of the asset at that time or the price that investors paid for the asset if the purchase occurred within the measurement period. The ending value is the current market price of the asset or the price that potential investors would pay to acquire the asset today.

Ex-Post Risk vs. Ex-Post Analysis

Whether you should have made the bet depends on whether you judge it on an ex-ante or ex-post basis. If you judged the toss by the information available to you at the time, it was a good bet ex-ante, since on average you could expect to come out 50 cents ahead. But if you judged by the information available to you after the coin was flipped and you had lost, you should expect a possible loss of $1 on an ex-post basis. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

Ex-ante demand refers to any demand that doesn’t result in the payment for or exchange of money for goods and services. Ex-post demand, on the other hand, means the actual demand for goods and services that are purchased during a single year within the economy. On one side, you’d have any gains experienced by the ETF while the other side would be populated by daily losses. Because these are the worst 5% of all daily returns, we can say with 95% confidence that the worst daily loss will not exceed 4%.

Widening the net: ACCC’s ambitious merger clearance threshold … – Clayton Utz

Widening the net: ACCC’s ambitious merger clearance threshold ….

Posted: Mon, 24 Jul 2023 01:17:27 GMT [source]

The prediction is not based on actual data, since the event will occur in the future, and does not know with certainty how the economic performance will be. Analysts may also provide ex-ante predictions at times when a merger is widely expected, but before it takes place. Such analysis takes into account potential cost savings related to paring redundant activities, as well as possible revenue synergies brought about by cross-selling. While the predictions may occur ex-ante, they may also take occur immediately after the completion of the transaction, but there is uncertainty on the expected performance. While the actual event (the merger) has already happened, the ex-ante analysis focuses on the major upcoming event after the merger.

Chapter 2: National Income Accounting

However, Krugman feels that it is better to err on the side of caution – it is better for inflation to overshoot than undershoot. In other words, the problems of inflation above the target are not symmetrical with the problems of inflation below the target. Given current knowledge of the economy, the best ex ante decision is to hold back from raising rates. When you use an ex-post analysis, you compare the ex-ante or projected return with the ex-post or actual return. This helps figure out how accurate the way risk assessment is done by a professional or investor.

- The distinction between ex-ante and ex-post is significant because all variables in the theory of income determination are ex-ante (planned) variables.

- Put another way, we expect with 95% confidence that our gain will exceed -4%, ex-post.

- The actual outcome is not known for certain, but making the prediction of the expected returns serves as the basis for comparing the predicted performance and the actual performance.

- To measure a security’s returns from 1st January to 31st March, we will calculate the difference between the opening (price on 1st January) and closing price (price on 31st March).

- This method presents the actual outcomes of the company based on historical data.

Simply put, it is the prediction of an event before it occurs, with the actual outcome being unknown. The obtained ex-ante value can then be compared to the actual performance when it occurs by making a prediction of the outcome. Ex-post represents the actual results achieved by the company, which is the return earned by the company’s investors, as opposed to ex-ante, which is based on estimated returns. Investors can use ex-post data to determine a security’s actual performance, excluding any forecasts or projections that may be influenced by market shocks.

An ex-ante interest rate is announced before the actual interest rate or ex-post rate is made public. The main difference between the two is that the ex-ante rate doesn’t take inflation into account while the ex-post rate does account for this figure. One type of ex-ante analysis that’s particularly useful to investors is gauging ex-ante earnings-per-share (EPS) analysis in the aggregate. Consensus estimates, in particular, help to set a baseline for corporate earnings. It’s also possible to gauge which analysts among the group covering a particular stock tend to be the most predictive when their expectations are notably above or below those of their peers. Ex-ante predictions can also be made when a merger is expected to be initiated.